fit on paycheck stub

The amount you see on your paycheck is based on W-4 information such as your filing status that is whether youre single or filing jointly with a spouse. This is the amount of money an employer needs to withhold from an employees income in order to pay taxes.

W2 Box 1 Wages Vs Final Pay Stub Asap Help Center

Just Click and Print Your Own Stub.

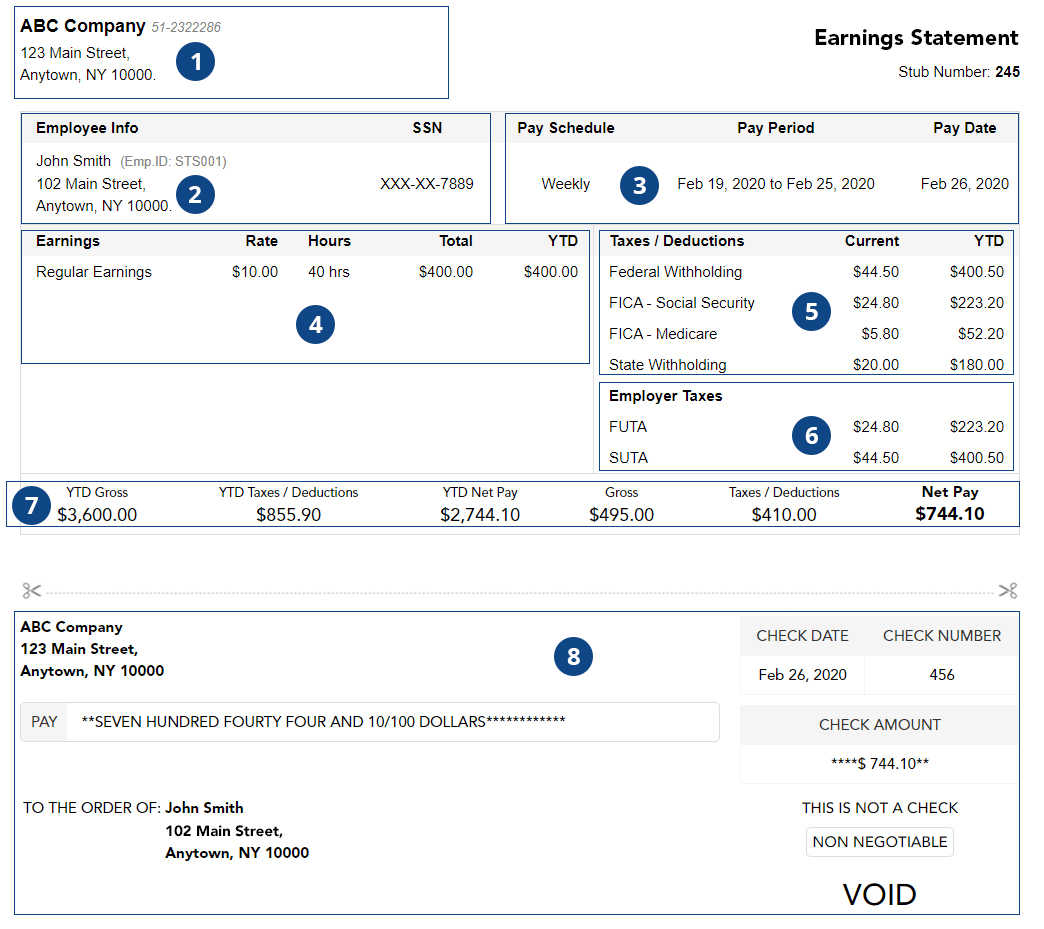

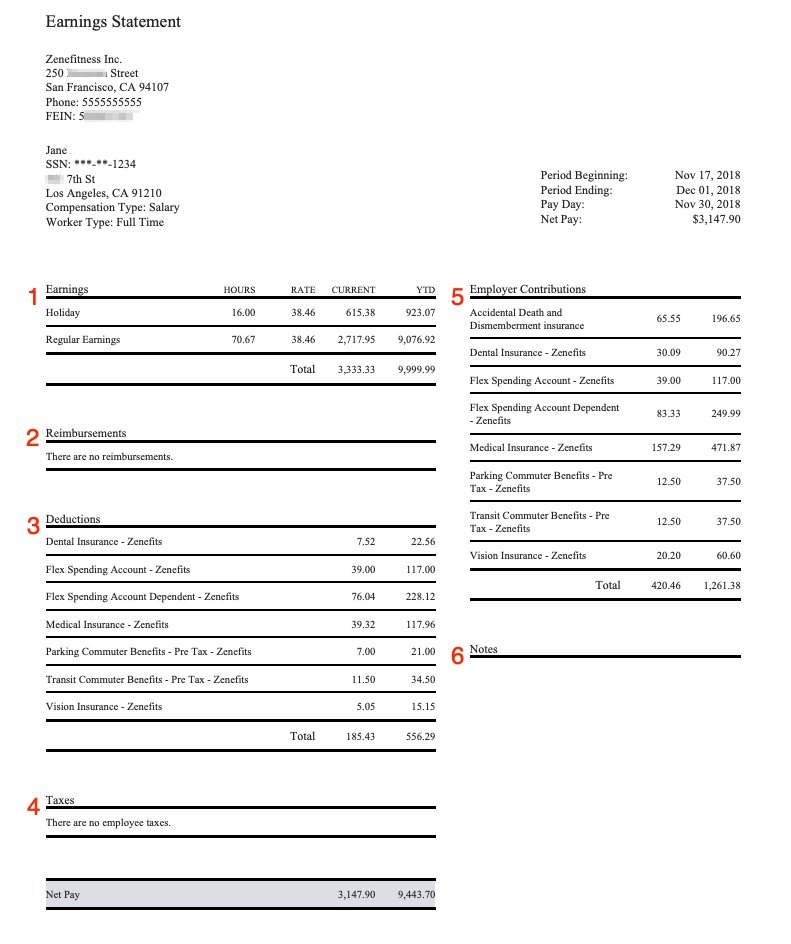

. Gross Pay and Net Pay. FIT deductions are typically one of the largest deductions on an earnings statement. Below are some items that are usually listed on a pay stub.

Paycheck Stub Abbreviations for Earnings. AAFES Pay Stubs W2s. FIT is applied to taxpayers for all of their taxable income during the year.

While the task of figuring out FIT withholdings for your employees may seem tricky with the help of Block Advisors payroll service or payroll software like Wave your payroll to-dos just got easier. Just Click Print Your Own Stub Instantly. Ad Simply Answer a Few Questions to Instantly Save Download Print Your Paycheck Stubs.

The information on a paystub includes how much was paid on your behalf in taxes how much was deducted for benefits and the total amount that was paid to you after taxes and deductions were taken. They go toward costs needed to run the federal government. Answer 1 of 2.

Your net income gets calculated by removing all the deductions. The name of the Employee. In the United States federal income tax is determined by the Internal Revenue Service.

The taxable wages for federal tax for withholding purposes is gotten by taking the gross pay and removing any exclusion that may exist for that employee. FIT means federal income taxes. EE stands for employee.

It gets removed from your pay added to the Social Security Tax on Medicare Tax Social Security Tax on Wages. AAFESs retail stores are also known as The Exchange and The PX. Fit stands for federal income tax withheld.

Employees generally receive a paycheck along with additional information an. How much you can expect to come out of your paycheck in federal income taxes depends on your age filing status and level of income you earn. Monthly payments for such types of insurance as health medical and dental and life insurance.

Federal Income Tax FIT is calculated using the information from an employees completed W-4 their taxable wages and their pay frequency. Lowest Cost Paycheck Stub Generator Online. Ariel SkelleyBlend ImagesGetty Images.

Some are income tax withholding. Now that you know whats included in the paycheck stub header its time to move on to your earnings. Additional Items that May Appear on Your Paycheck Stub.

Create Your Stub In Under a Minute. A paycheck stub summarizes how your total earnings were distributed. Calculate Federal Income Tax FIT withholding amount On emphasis determining the correct federal tax withheld depends on what the W-4 form you filed with your employer says.

A company specific employee identification number. Personal and Check Information. FIT stands for Federal Income Tax.

Based on Publication 15-T 2021 Federal Income Tax Withholding Methods you can use either the Wage Bracket Method or the Percentage Method to calculate FIT. Some entities such as corporations and trusts are able to modify their rate through deductions and credits. Here are some of the general pay stub abbreviations that you will run into on any pay stub.

Your pay stub will also show how much youve earned during the year so far and for that pay period. Other groups such as. Withholding is one way of paying income taxes to the.

Save Time Money Today. AAFES is a sub-agency of the United States Department of Defense that provides retail products at discounted prices for active and retired members of the United States Army and Air Force. General Pay Stub Abbreviations.

FIT represents the deduction from your gross salary to pay federal withholding also known as income taxes. FICA would be Social Security and Medicare which are not deductions nor credits on your income tax return. FIT on a pay stub stands for federal income tax.

This is the amount of money earned during the pay period. Although not required the following are items that may appear on your paycheck stub and are useful to money management and relevant to your employment status. The dates for the pay period should also appear somewhere on the stub.

Paycheck stubs are normally divided into 4 sections. 6 days ago Jan 29 2022 A pay stub which most people who work corporate jobs receive at the end of each pay period is the most common form of proof of income. The rate is not the same for every taxpayer.

With 65000year salary - your bi-weekly Gross Pay should be 2500 Federal Withholding 385 Social Security 105 Medicare 36 Connecticut state income tax withholding 122 - seems as your actual deduction is much higher - that is a question to your payroll person. TDI probably is some sort of state-level disability insurance payment eg. FIT is applied to taxpayers for all of their taxable income during the year.

This is likely the part of your paycheck youre most concerned about as it details the amount of money you are receiving. Estimated net pay 1852 Your actual withholding might different depending on many. There are at least 4000 exchange stores globally including the.

FIT Fed Income Tax SIT State Income Tax. The Employees social security number. Your pay stub will also show how much youve earned during the year so far and for that pay period.

So I assume on a payroll check it means the employees income tax has been withheld. The last part of your paystub is where youll find the deductions. 1 medicare and 2 social.

Ad Create Paycheck In Under a Minute. Here is a list of paycheck stub abbreviations that relate to your earnings. It covers two types of costs when you get to a retirement age.

Fit stands for Federal Income Tax Withheld. These items go on your income tax return as payments against your income tax liability. FICA means Federal Insurance Contribution Act.

These are any amount of money thats taken from your paycheck before you get it. Evaluating Your Earnings Statement. Your earnings statement indicates your gross pay which is the total amount of money earned for.

How is fit calculated on paycheck. Be sure to ask for the applicants most recent pay stubs so you can verify that they are still at that job and receiving that income and confirm their monthly earnings. FITW is an abbreviation for federal income tax withholding Youll sometimes see it on payroll stubs to identify your withholding deductions.

FIT is withheld from an employees paycheck based on the amount of their federal taxable wages. What Is the FIT Deduction on My Paycheck.

Pay Stub Copy Generator Pdfsimpli

Gross Vs Net Pay What S The Difference Between Gross And Net Income Ask Gusto

Why Your Paychecks Might Be Bigger Right Now Nextadvisor With Time

Explore Our Sample Of Pay Stub Template For Nanny Payroll Template Payroll Checks Templates

What Everything On Your Pay Stub Means Money

Decoding Your Pay Stub Infographic Money Management Decoding Understanding Yourself

Sample Pay Check And Fica Taxes Savings For Cpt Opt Studetns

Understanding Your Paycheck Credit Com

Understanding Pay Stub Understanding Paycheck Stub

Independent Contractor Pay Stub Template Lovely Free Paystub Generator For Self Employed Fill Line Best Templates Templates Powerpoint Timeline Template Free

A Pay Stub Or Paycheck Stub Is A Document That Is Issued To By An Employer To His Her Employee As A Notification That P Payroll Checks Payroll Payroll Template

A Guide On How To Read Your Pay Stub Accupay Systems

Get Our Example Of Direct Deposit Check Stub Template For Free Statement Template Word Template Templates

Understanding Your Paycheck Stub Information Earnings Deductions How To Read Your Pay Stub Iris Fmp

What Does A Pay Stub Look Like Workest

Fillable Form Pay Stub Budget Forms Paying Paycheck

Online Custom Pay Stubs Online Custom Pay Stub Generator Payroll Template Paying Custom