how to purchase tax liens in alabama

40-10-21 and 40-10-132 Alabama Department of Revenue. In 2018 Governor Kay Ivey signed into law Act 2018-577 providing counties an alternative remedy for collecting delinquent property taxes by the sale of a tax lien.

Late Paying Your Property Tax Investors See An Opportunity Wbhm 90 3

If the property is not redeemed within the 3 three year.

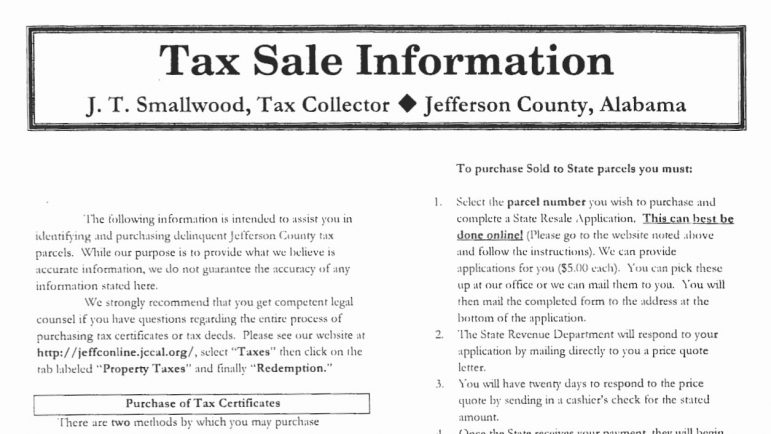

. Call your county tax collection office better yet visit in person if you can and ask about the procedures in your. You are given 10 calendar days from the date on the price quote to remit your payment. I have a free gift for you.

You may request a price quote for state-held tax delinquent property by submitting an electronic application. Smart homebuyers and savvy investors looking for rich money-making opportunities buy tax-delinquent properties in Alabama at tax lien auctions or online distressed asset sales. This is because as the initial lien holder you will be required to purchase any subsequent liens.

Legal Division Tax Violations To report a criminal tax violation please call 251 344-4737 To report non-filers please email taxpolicyrevenuealabamagov Contact 50 N. Theyre always available and theyre going to sell them at least once a year at an auction. When investors buy the liens at auction they pay the full amount of taxes owed.

In 67 counties in Alabama you can buy a tax lien certificate. Ad Get Deals on Cheap Tax Lien Property for Sale in Alabama. ALABAMA Code 35-11-213 mandates that a notarized ALABAMA Statement Of Lien can be recorded at any time up to four 4 months Subcontractors or six 6 months.

Tax liens are purchased with a 3 year redemption period and a 12 percent annual rate of return or 1 percent per month. Search all the latest Alabama tax liens available. Step 1 Find out how tax sales are conducted in your area.

New tax liens take precedence over old liens. Buying tax liens at auctions direct or at other sales can turn out to be awesome. A Alabama tax lien certificate transfers all the rights that come with being the owner of the real estate tax lien from Shelby County Alabama to the.

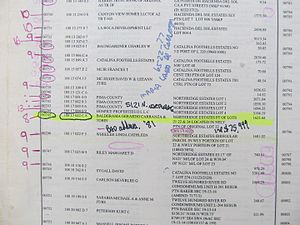

Once your price quote is processed it will be emailed to you. Tax lien certificates not sold at the county level can be purchased from the Alabama State Commissioner of Revenue Sec. Sad but true Competition.

This law vests the taxing. There are more than 51469 tax liens currently on the market. In exchange they get the right to collect that money back plus money in interest and fines.

Some counties pay interest on both the minimum and premium bid. A tax lien is simply a claim for taxes. Search all the latest Alabama tax liens available.

Greater Talladega Lincoln Chamber Of Commerce Alabama Tax Structure

Alabama Sales Tax Holiday Begins This Month The Troy Messenger The Troy Messenger

Investing In Tax Liens Is It A Good Idea Alabama Real Estate Lawyers

Louisa County Tax Delinquent Sale Of Real Estate

A Guide Through The Tax Deed States Are They Legal

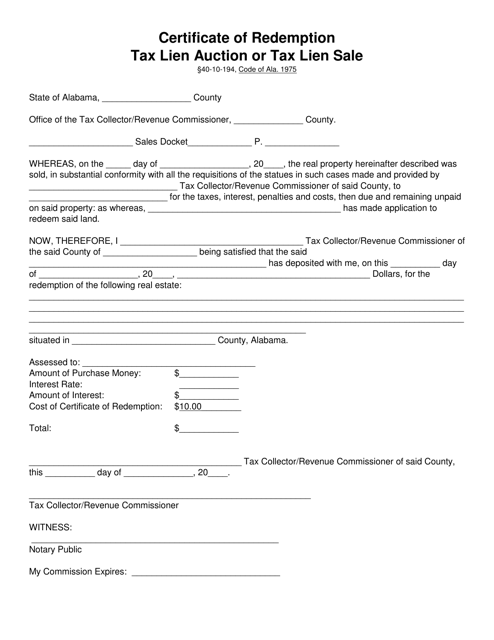

Alabama Certificate Of Redemption Tax Lien Auction Or Tax Lien Sale Download Printable Pdf Templateroller

Tax Sale Dekalb Tax Commissioner

Free Alabama Boat Vessel Bill Of Sale Form Pdf

Alabama Tax Liens Premier Tax Liens

Who Pays The Highest Property Taxes In Alabama Al Com

Bid4assets Com Auction Detail 997785 Notice Of Sale Lee County Alabama Live Tax Lien Sale 724 Liens

Alabama Department Of Revenue Proposes Sales Use Tax Regulations To Unify Casual Sale Rules Cooking With Salt

Faq Alabama Tax Lien Auctions Butler Evans Education

Alabama Sales Use Tax Guide Avalara

State Map Www Secretsoftaxlieninvesting Com

Faq S National Tax Lien Association

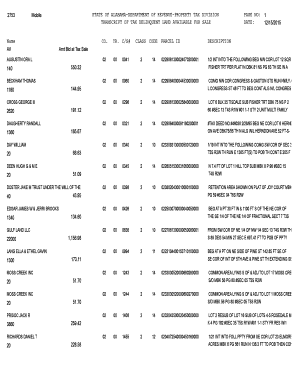

Fillable Online Revenue Alabama Transcript Of Tax Delinquent Land Available For Sale Revenue Alabama Fax Email Print Pdffiller

Abandoned Properties Locked In Limbo As The Tax Bill Grows Wbhm 90 3